Ghosts, Jewels, Etc. 10 Unusual Claims

Scared Jobless

The inventory specialists with claims pros Enservio visit some strange homes, but none of them were prepared to handle a domicile that was supposedly haunted—so much so that it pushed one specialist to the point of quitting his job.

The adjuster(s) assigned to investigate “were a little bit wary,” says Jay Straughan, Enservio’s vice president of claims. “But they didn’t believe [the house was haunted]—until they noticed the second time they walked by a particular room, that a chair in that room was in a different position. And as they walked by it a third and fourth time, the chair was in different positions again.”

The eeriness didn’t end there. When the inventory specialist came home that evening and looked at the photos that were taken at the house, the figure of a ghost could be seen in one of them.

“It was a white shadow that had an almost human form to it,” explains Straughan. So where’s the photo now? “I asked for the photograph—and it vanished. No one has it anymore.”

The visit to this home had spooked the inventory specialists on site so badly that one of them decided to quit their job the very next day.

“Their comment was, ‘This pushed me over the edge,’” says Straughan. “’I am not going to subject myself to anything like that ever again.’”

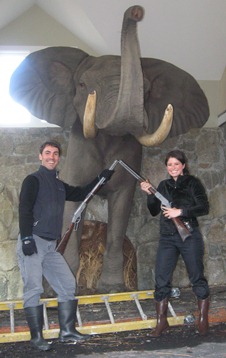

Big-Game Collector

“A high-end insurance company insured a real estate developer from the city, and he built this mammoth compound outside the city in the Hudson Valley,” recalls Tom Kirkpatrick, consulting founder at Enservio and president of Contents Consulting LLC with expertise in antiques and fine art. “He built it with a thatched roof, and the insurance company refused to write coverage on the house because they thought it was a fire hazard—a pretty good call on their behalf.

“However, because he had his home in the city insured, there were some coverages that extended. So, when the client did have a fire, we got a call to go to the estate.”

What the agents found when they got to the site was beyond what any of them could have imagined. The homeowner—who happened to be a big-game hunter—had life-sized taxidermed African animals worthy of the American Museum of Natural History in the middle of his living room, including a full-bodied giraffe and an African elephant.

“We find that there are collectors for many different reasons,” says Kirkpatrick of the kinds of clients he works with. “It makes my job fascinating speaking to these people as to what they collect and why.”

Cash on the Books

Oftentimes as an insurance agent, you need to have a “What can go wrong, will go wrong” outlook. However, not everyone thinks with an insurance-centric  mind, as Donna Pile, owner of A. G. Perry Insurance Agency in Lexington, Ky., discovered when one of her clients called to file a claim for $700 in cash that was stolen from her “bank.”

mind, as Donna Pile, owner of A. G. Perry Insurance Agency in Lexington, Ky., discovered when one of her clients called to file a claim for $700 in cash that was stolen from her “bank.”

“She failed to tell me that her ‘bank’ was the library in her house,” says Pile. “She had stuffed money in the pages of her books in her library, and somebody opened a book one day and found money, and then kept finding more money, so they took it.”

When Pile asked the client just how much cash she had in between the pages of her library, “I about fell over, because it was a whole lot of money,” the agent recalls. “She had thousands and thousands of dollars in that library. If she had a fire, it would’ve all been gone.”

The policy only covered $250 cash, which Pile says the client was happy to get. She advised the client to move the money into a more secure and protected location; whether or not she actually did so is not known.

Claims of the Rich & Famous

Among the elite clients Kirkpatrick works with are Hollywood stars and professional athletes, whose everyday claims are things most of the population doesn’t deal with.

“I had a claim where a star tennis player’s Wimbeldon trophy was stolen,” he recalls. Also stolen was a couture gown that was worn by an Academy Award winner when she accepted her award for Best Actress. “This couture gown now has the cache and panache of having been worn and viewed at the Oscars,” says Kirkpatrick, who was left with the task of determining the gown’s new worth.

“I also had a claim where a famous actor’s Academy Awards and BAFTAs fell from a glass shelf, and we had to get those all replaced,” says Kirkpatrick. “How often do you get to do something like that? I’m lucky I get to.”

Oh, Those Old Royal Things?

Working with many high-net-worth clients, Kirkpatrick has dealt with some characters. When working with one such claimant after a fire at her estate, he was stunned by the callous way the New York socialite referred to international royalty.

“I picked up a mirror that was damaged, and asked for specific details,” says Kirkpatrick. “I’ll never forget: She tipped her head, looked at it, and said, ‘Oh, that was a wedding present from the Queen [of England].’ Then she paused and said, ‘I don’t mean the twit that’s there now; I mean the Queen Mum.’

“Being of middle-class demographics myself, the fact that this woman could speak of the Queen as frankly as she did just kind of shocked me,” laughs Kirkpatrick.

In the same home, one agent found a stunning gold-plated and engraved shotgun hidden behind a row of books in the library. When shown to the client, she casually said, “Oh, where did you find it? That was a present from the King of Spain. It’s so pretty to look at, but doesn’t shoot worth a damn.”

Burnin’ Love

You’re from a very prominent and wealthy family. You live in a home that was constructed to look like a Medieval castle, atop a Malibu mountaintop.  A wildfire is approaching your home, and you have to evacuate immediately. What would you grab before you left?

A wildfire is approaching your home, and you have to evacuate immediately. What would you grab before you left?

In this unfortunate claim, the homeowner grabbed her Persian cats and Elvis Presley’s army fatigues.

“She was an Elvis fan,” says Kirkpatrick. “She had gone to Graceland and attended auctions and accumulated a collection.

“She had two cats, and she grabbed Elvis’ army fatigues—and that’s all she managed to escape with,” he explains. “The large, three-story estate burned down to nothing.”

In addition to the homeowner’s Elvis memorabilia, other items lost include a chandelier “that was probably 25 feet tall, in a pink, rose-colored cut crystal that was just incredible,” he says. “And the family had one of the largest jewelry collections in the world, after Queen Elizabeth. A good part of it was destroyed in the fire.”

International Bank Theft

Enservio’s Straughan recalls one claim that involved 200 different policyholders and resulted in a loss of over $5 million when thieves robbed an international bank.

“The thieves figured out that if they dropped in through the ceiling, they could get into the bank vault—and they did,” explains Straughan. “With no guards on duty, they got into 200 safety deposit boxes, most of which had cash and jewelry in them.”

Among the stolen treasures was a tourmaline rubellite necklace with a 190-karat stone worth $35,000 and a pink diamond appraised for $780,000. One particular box had over $3 million worth of valuable items in it.

“[The loss] was absolutely tragic,” says Straughan.

Trash to Treasure

One of the important aspects of inventorying a home after a major loss is making sure that everything is accounted for. Without careful inspection, one of Kirkpatrick’s clients could have carelessly lost $400,000.

carelessly lost $400,000.

“She and her husband were cornerstones of the New York social scene,” says Kirkpatrick. “They had a fire at their waterfront home in Connecticut, and when I arrived, there was a restoration company already on site. They were throwing everything that was damaged in the house in the dumpster—not recording it, not doing anything with it.

“I stopped that activity and brought in a second dumpster, and started going through each item with the homeowner.”

What Kirkpatrick found was a huge relief to the homeowner.

“I picked up a designer handbag with some fire damage, and opened it. Inside the side pocket was a diamond and sapphire necklace worth $400,000,” says Kirkpatrick. “They had just tossed it! I remember the client’s face when she saw it. It wasn’t damaged at all.”

It was the Maid in the Library with a Paintbrush

One policyholder was convinced that her housekeeper had damaged a 12-piece collection of paintings by a very prominent artist.

“The person believed that their housekeeper had taken different painting and artistic utensils and changed the original paintings by the artist,” explains Straughan. “But because fine art is well documented, we were able to compare the works in the policyholder’s possession with images from the artist’s catalogue and note that, in fact, no changes had been made.”

May Cause Breast Growth

One of the more unusual claims that Gregory Vallie, director of casualty claims for Burns & Wilcox, encountered in his career didn’t involve a loss—in fact, it involved a gain.

A young man sued a nutrition center after he developed breasts from taking a banned substance from China that was being sold at the center.

“The USDA had taken that particular product off the market, and [the nutrition center] failed to do that,” says Vallie. “The product contained an anabolic steroid, and he developed ‘man boobs.’”